Most high-net-worth individuals (HNWI) aren’t just sitting on a pile of cash. They’re investing, buying, selling, and exploring ways to grow their wealth through new ventures. The best part? You might classify as an HNWI without even knowing it.

Wealth is a loaded word. So, let’s unpack what ‘wealth’ means for today’s high-net-worth individuals. What metrics classify them as such? And what moves can they make this year to enshrine their wealth for future generations?

Why You Might Be a High-Net-Worth Individual Without Knowing It

It sounds ludicrous. How can someone not realize they’re a high-net-worth individual? Well, it’s more common than you think, as the designation primarily stems from asset appreciation over time.

For example, someone may have bought property many years ago while the market was down or the area wasn’t as valuable.

As the market recovered and new buyers and businesses moved in, their property value shot through the roof. Perhaps they’re sitting on a $1 million asset without even knowing it.

They could also have a hefty amount in retirement savings, investment growth, or other asset appreciation they didn’t factor into their overall net worth. This might be the kind of person who runs a successful business but ties their money up in assets instead of liquid cash.

Learning you’re an HNWI is a nice surprise, but why does that matter? How does it change your life? For starters, high-net-worth individuals have unique investing needs and personas. Some are open to risk; others are more conservative. Some focus more on family and estate planning, while others want to expand their circle of influence.

Partnering with a financial institution that shares your HNWI personality is the best way to attain your future goals.

Who Are High-Net-Worth Individuals (HNWI)?

Forbes defines high-net-worth individuals as anyone who owns $1 million or more in liquid assets, but there’s no ‘set-in-stone’ blueprint for what makes an HNWI. Financial institutions may employ their benchmarks before considering you an HNWI.

It all boils down to liquid assets—money held in a bank or brokerage account. Your HNWI status doesn’t consider physical assets like your primary residence, personal vehicles, durable goods, or collectibles. Regardless, cash is not the only measure of being a high-net-worth individual.

Assets like business ownership, its properties and equipment, real estate, and even a sizable chunk of retirement savings can put you at such a status. It may surprise you that your business that generates a consistent, moderate income may give you the assets you need.

High-net-worth individuals play a critical role in the global economy. Their financial portfolios are more complex than the standard checking, savings, and retirement accounts.

They’re also defined by the ways they maximize their generated income and putting additional funds into their investments and retirement accounts. They also take advantage of financial services that help them find their identity.

Sustainable income also plays a significant role. You might have $1 million this year—but will you make enough next year to sustain it? That income may stem from your investments, career, business, or royalties: however, you currently make money.

So, with all that said, are you a high-net-worth individual?

What HNWIs Must Do to Protect Wealth and Loved Ones

Reaching over $1 million in liquid assets is an impressive milestone. Now comes the time to grow, invest, and protect it. Let’s dive into some best practices high-net-worth individuals can leverage to pass that wealth onto their loved ones someday.

Identifying Your Purpose and Values (And If They’ve Changed)

What are your goals and values? Have they changed over the years? How can you use your status as an HNWI to—as Gandhi said—be the change you want to see in the world?

Values-based investing walks the line between thinking and feeling. In the end, you’ll land somewhere between the most logical investment decision and what feels right to you. This is also known as impact investing, or investing in companies that share your values.

For example, if you care about ESG (environmental, sustainable, governance) metrics, you’d invest in a company that promotes all three while maintaining a profitable business strategy.

We’re seeing emerging value/impact-based investing trends regarding women in today’s market.

According to an Ellevest Financial Wellness Survey, about a third of Gen Z women and more than 25% of Millennial women say impact investing is vital to them.

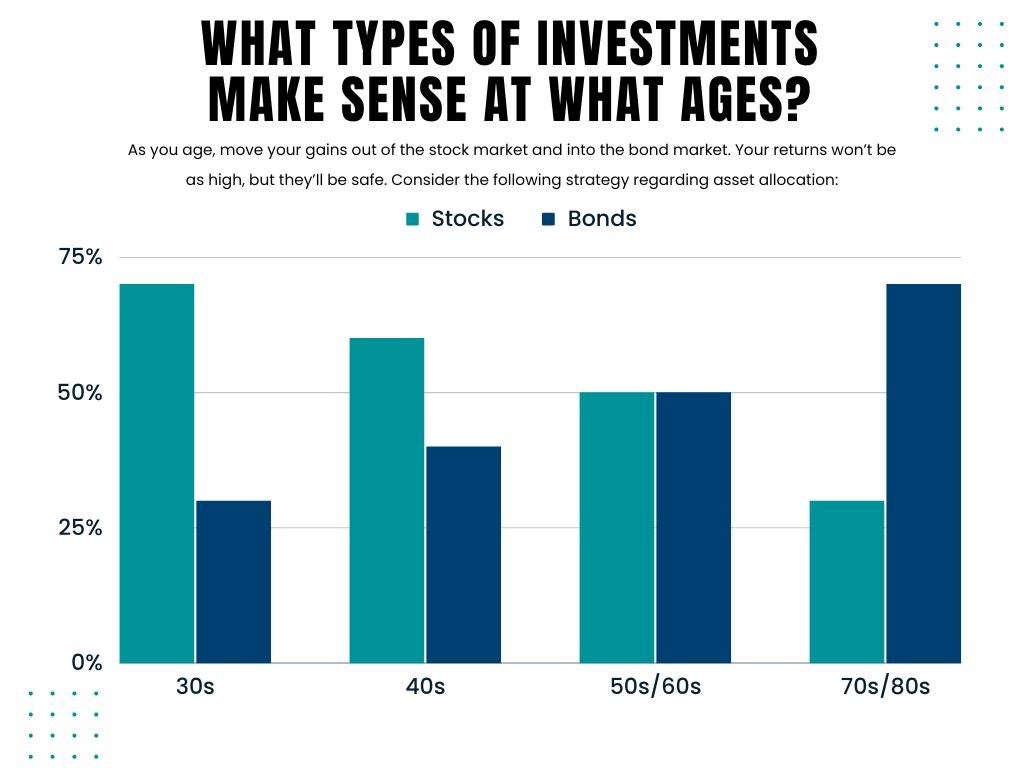

What Types of Investments Make Sense at What Ages?

Your priorities change as you age, and as your priorities change, so will your investments. As such, it’s important that high-net-worth individuals—or those who aspire to be—understand proper asset allocation based on their age.

When you’re just starting out in your early 20s, lean heavily into stocks (80%), with some bonds to fall back on (20%). You have plenty of time to ride out market volatility. Stocks are among the best ways to grow your wealth during the early stages.

Tax Considerations

High-net-worth individuals pay more in taxes; it’s a fact of life. That’s why proper tax planning is crucial for protecting and growing your wealth. Here are some ways to legally lower your tax liability as an HNWI.

Max Out Your Retirement Accounts

For 2023, you can contribute a deductible maximum of $22,500 to your 401(k) or any related retirement account. (Those 50 and older can contribute another $7,500 to their 401(k) in 2023).

Many high-net-worth individuals are self-employed, meaning they can also contribute employer contributions to their accounts to double their input effectively. Speak with your trusted financial partner regarding other ways to leverage retirement savings when tax planning.

Consider Tax Loss Harvesting

Tax loss harvesting is a popular year-end strategy among high-net-worth individuals. It entails selling depreciated assets to offset capital gains, thus lowering your tax liability. Tax harvesting also helps rebalance your portfolio for the new year.

Donate to Charity

Donating is a great way to live by your personal values while lowering your liabilities. The IRS lets you deduct eligible charitable contributions up to 60% of your adjusted gross income (AGI).

Start Securing Your Wealth Today

High-net-worth individuals must understand the importance of protecting their wealth. If you are an HNWI—or have recently become one—consider leaning on a trusted financial partner, like Illinois Bank & Trust, a division of HTLF Bank, to help manage your financial needs.

Get in touch with Illinois Bank & Trust, a division of HTLF Bank today to speak with a wealth advisor with deep market insight. Together, you can form a financial strategy to preserve and grow your hard-earned wealth.

Wealth Management does not provide accounting, legal or tax advice. This information discusses general economic and market activity and is presented for informational purposes only and should not be construed as investment advice. Views and opinions expressed herein do not account for any specific investment objective, restrictions, and/or financial circumstances of any specific client. Investors are urged to consult with their financial advisors before buying or selling any securities.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. The investment return and principal value of investment securities will fluctuate based on a variety of factors, including, but not limited to, the type of investment, amount and timing of investments, changing market conditions, currency exchange differences, stability of financial and other markets, and diversification. The statements and opinions expressed in this article herein are those of the author as of the date of the article and are subject to change. Content and/or statistical data may be obtained from public sources and/or third-party arrangements and is believed to be reliable as of the date of the article.

Products offered through Wealth Management are not FDIC Insured, are not bank guaranteed and may lose value.